Investment Process

To sum up our investment process in one word: Tailored. Your investment plan may share many of the same investments as our other clients but the allocation is directly reflective of your goals and what you want to achieve. Depending on you and your goal(s), we can use any number of investment vehicles and combinations to create a tailored investment portfolio such as:

- Individual stocks and bonds

- Institutional & retail mutual funds

- Exchange Traded Funds (ETFs)

- Tax-advantaged investing

- Fixed income investing

- Real Estate Investment Trusts (REITs)

- Alternative Investments

- Separate managed accounts

- Annuities

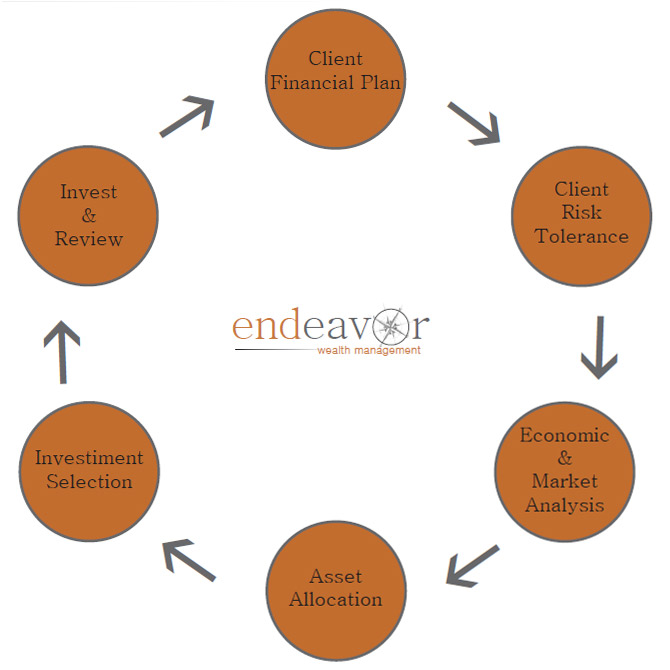

Initial Investment Process

The flow chart below gives an overview to our investment process:

The primary driver to the asset allocation we choose for you is by determining the overall portfolio risk that should be taken in consideration of your goals. Once we build your financial plan then we are able to understand the return you need to achieve your goals. Your plan and the process we follow will tell us the benchmark or desired return you need in order to achieve your goals. But it is your risk tolerance that determines to what extent risk can be taken. It is very important that a client understand the amount of risk they are taking because this is the only way to clearly set expectations.

Economic and market analysis shapes the suggested asset allocation based on your financial plan and risk tolerance. We keep perspective on historical data but strive to deliver forward looking models. Your asset allocation takes shape through the process and the outcome is an asset allocation that is tailor made to you. We select the appropriate investments that together provide the risk benchmark we have determined.

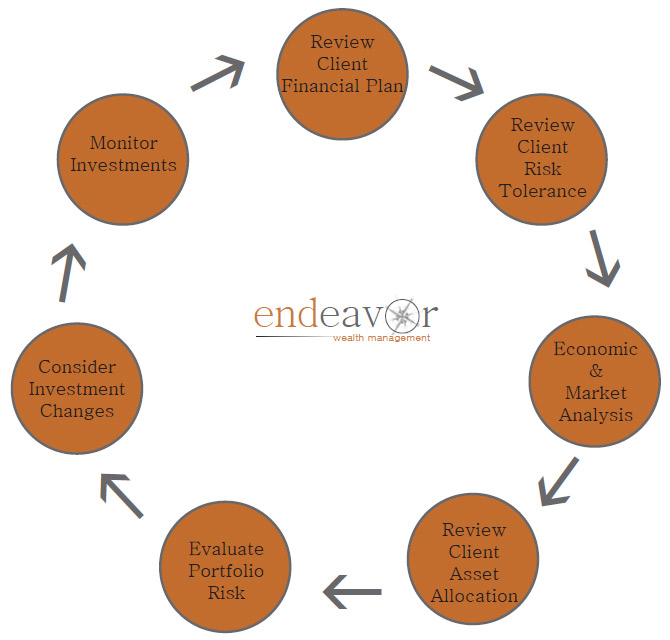

Continuous Investment Process:

There are a couple additions to our process after the initial investments are made. The biggest change is how we monitor the risk in your portfolio. This is a continuous process and one that heavily determines on-going changes in the investments you hold. The goal is to always keep the portfolio risk in line with the long term risk benchmark we have determined is needed to reach your goals. This process will help us both in understanding how we are doing in the progress towards your goals. And it creates a process where there is an understanding for any changes made.

No strategy assures success or protects against loss

Asset allocation does not ensure a profit or protect against a loss.